Unknown Facts About Nj Cash Buyers

Unknown Facts About Nj Cash Buyers

Blog Article

Indicators on Nj Cash Buyers You Need To Know

Table of ContentsThe Buzz on Nj Cash BuyersThe Best Strategy To Use For Nj Cash BuyersIndicators on Nj Cash Buyers You Should KnowLittle Known Facts About Nj Cash Buyers.

Many states give consumers a specific level of security from lenders regarding their home. Some states, such as Florida, totally exempt the house from the reach of specific financial institutions. Other states set limits ranging from as little as $5,000 to up to $550,000. "That implies, no matter of the value of the home, lenders can not force its sale to please their insurance claims," states Semrad.If your home, for instance, deserves $500,000 and the home's home mortgage is $400,000, your homestead exemption could stop the forced sale of your home in order to pay financial institutions the $100,000 of equity in your home, as long as your state's homestead exemption goes to least $100,000. If your state's exemption is less than $100,000, a insolvency trustee could still force the sale of your home to pay lenders with the home's equity over of the exemption. If you fail to pay your building, state, or government taxes, you could shed your home through a tax lien. Buying a residence is much simpler with money.

(https://www.codementor.io/@njcashbuyers07102)I recognize that several vendors are more likely to accept a deal of money, however the seller will certainly obtain the cash regardless of whether it is funded or all-cash.

Nj Cash Buyers for Dummies

Today, about 30% of United States property buyers pay money for their homes. There may be some great reasons not to pay cash money.

You may have credentials for a superb home mortgage. According to a recent research study by Money publication, Generation X and millennials are thought about to be populaces with one of the most potential for growth as borrowers. Handling a bit of financial obligation, particularly for tax objectives fantastic terms could be a much better option for your financial resources generally.

Perhaps buying the stock market, mutual funds or a personal organization might be a far better option for you over time. By purchasing a home with cash money, you risk diminishing your book funds, leaving you prone to unforeseen maintenance expenses. Possessing a property entails recurring prices, and without a home mortgage padding, unanticipated repair work or restorations might strain your finances and impede your capacity to preserve the building's problem.

Things about Nj Cash Buyers

Home costs climb and drop with the economy so unless you're intending on hanging onto your house for 10 to three decades, you could be much better off spending that money elsewhere. Acquiring a home with cash can accelerate the acquiring procedure considerably. Without the requirement for a home loan approval and associated paperwork, the transaction can shut much faster, supplying an one-upmanship in competitive genuine estate markets where vendors may favor cash money customers.

This can result in considerable expense financial savings over the long-term, as you won't be paying interest on the lending quantity. Money purchasers commonly have stronger settlement power when managing sellers. A money deal is extra eye-catching to vendors since it decreases the threat of a deal failing because of mortgage-related problems.

Keep in mind, there is no one-size-fits-all service; it's necessary to customize your decision based on your individual scenarios and long-term aspirations. Ready to begin checking out homes? Offer me a call anytime.

Whether you're liquidating assets for a financial investment building or are faithfully saving to acquire your desire abode, acquiring a home in all cash money can significantly raise your acquiring power. It's a critical move that reinforces your placement as a purchaser and improves your flexibility in the property market. It can put you in a financially at risk area.

The 30-Second Trick For Nj Cash Buyers

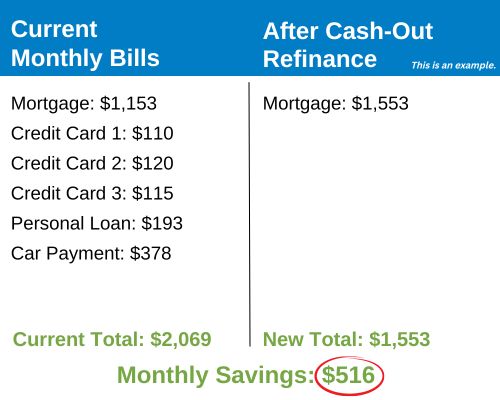

Minimizing rate of interest is just one of one of the most usual factors to get a home in cash money. Throughout a 30-year mortgage, you can pay 10s of thousands or also numerous hundreds of bucks in complete passion. Additionally, your getting power raises without financing contingencies, you can discover a broader selection of homes.

Property is one financial investment that has a tendency to outpace inflation over time. Unlike stocks and bonds, it's considered much less dangerous and can give short- and long-lasting wealth gain. One caution to note is that during certain financial markets, property can generate less ROI than various other financial investment key ins the short-term.

The biggest risk of paying cash for a residence is that it can make your finances unpredictable. Locking up your fluid possessions in a home can decrease financial adaptability and make it a lot more challenging to cover unforeseen expenses. Additionally, binding your cash money suggests missing out on high-earning financial investment possibilities that can produce greater returns elsewhere.

Report this page